Managing money seems straightforward—earn, spend, save. But the reality? Many people make financial mistakes that drain their wallets and delay their goals. If you want to build wealth and avoid common financial traps, watch out for these five money mistakes:

1. Ignoring a Budget (or Not Having One at All)

A budget isn’t a punishment—it’s a roadmap for your money. Without one, you’re spending blindly, often living paycheck to paycheck without realizing where your money is actually going.

Fix It:

- Use budgeting apps or a simple spreadsheet to track income and expenses.

- Follow a budgeting method like the 50/30/20 rule (50% needs, 30% wants, 20% savings).

2. Relying Too Much on Credit Cards

Swiping a credit card feels easy—until the debt piles up. High interest rates turn small purchases into financial nightmares, making it difficult to pay off balances.

Fix It:

- Pay your balance in full each month to avoid interest charges.

- Use credit responsibly—only for planned expenses you can afford.

- If you have debt, prioritize high-interest payments first (avalanche method) or tackle smaller debts for motivation (snowball method).

3. Not Having an Emergency Fund

Life happens—unexpected car repairs, medical bills, or job loss. Without an emergency fund, people rely on credit cards or loans, sinking deeper into debt.

Fix It:

- Aim for 3–6 months’ worth of expenses in an easily accessible savings account.

- Start small—set aside a portion of every paycheck until you build a safety net.

4. Delaying Investing

Many people think they need to be rich to invest, but delaying means missing out on compound growth. The longer you wait, the harder it is to catch up.

Fix It:

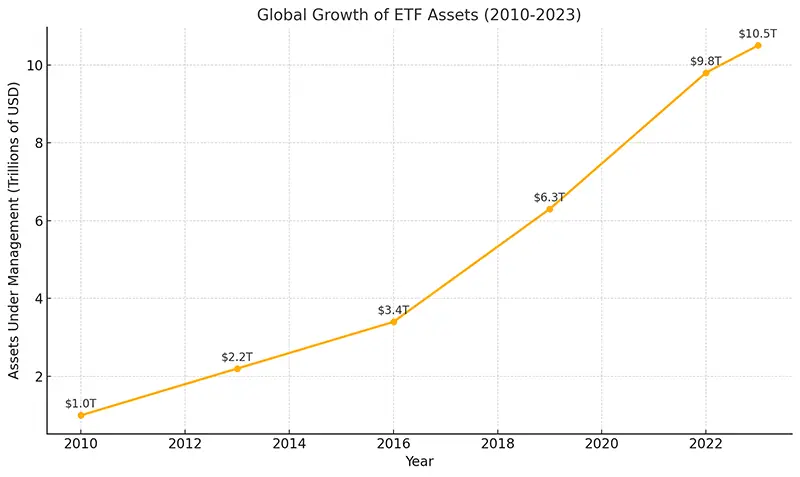

- Start now—even with small amounts. Consider low-cost index funds or Roth IRAs for long-term growth.

- Take advantage of employer-sponsored retirement accounts like a 401(k), especially if there’s a company match (free money!).

5. Lifestyle Creep

As income rises, so do expenses. It’s tempting to upgrade your car, home, or wardrobe, but if spending grows with your salary, saving and investing take a back seat.

Fix It:

- Maintain a modest lifestyle even as your income increases.

- Increase savings and investments with every raise before upgrading your lifestyle.

- Differentiate between wants and needs before making major purchases.

Final Thoughts

Financial mistakes are easy to make—but they’re also fixable. The key is awareness and taking small, intentional steps toward smarter money management. By avoiding these traps, you’ll set yourself up for financial security and long-term success.