July 2nd SALE… 90% off today!

New! Investing Cheat Sheets

Designed for quick reference on the most important investment concepts—no fluff, just clear and practical insights. For both beginner & seasoned investors, these cheat sheets are a go-to guide for key strategies and avoiding costly mistakes. Print one out whenever you need it!

Why Cheat Sheets Instead of a Book?

Say goodbye to endless page-turning. These cheat sheets give you instant access to key info—clearly laid out for speed and simplicity. Need it on the go? Just print a copy or save it to your phone. They’re made to fit seamlessly into your daily life—whether you keep one in your pocket, post it by your desk, or carry it in your bag.

Why Choose Our Cheat Sheets?

Comprehensive & Easy to Understand

We’ve simplified complex investing concepts into bite-sized, easy-to-follow tips. Perfect for quick reference.

Convenient and Accessible

Forget lengthy finance books! Our cheat sheets are designed for on-the-go learning—print out what you need, when you need it.

Time-Saving Strategies

Learn practical, proven investing techniques without spending hours on research.

Investing Guides

Access useful reference guides that cover asset allocation, risk management, and portfolio strategies to make investing easier.

Avoid Common Mistakes

Learn how to sidestep common investing pitfalls, from stock market missteps to bond strategy errors, so you can maximize your returns while minimizing risk.

Covering Essential Topics

From stocks, ETFs, and bonds to REITs, options, and retirement accounts, our cheat sheets cover the must-know investing topics.

Some of the Many Topics Covered:

Investing Fundamentals:

Core Principles for Building a Strong Investment Foundation

Key Principles:

Learn the key principles of investing, set clear goals, outpace inflation, and take steps to secure financial stability.

Risk & Return Fundamentals:

Explore how potential rewards are tied to varying levels of risk, and learn strategies to balance the two according to your financial goals and comfort with uncertainty.

Diversification & Asset Allocation:

Discover why spreading investments across different assets helps minimize losses and stabilize returns, and learn the foundations of building a balanced portfolio.

Compounding Interest:

Understand the math of how reinvested earnings accelerate growth over time, turning small contributions into substantial gains through the power of exponential expansion.

Understanding Asset Classes:

Get acquainted with the main categories of investments—from stocks and bonds to real estate and commodities—and learn how each fits into a well-rounded portfolio.

Financial Markets Overview:

Gain insight into the global markets where financial assets are bought and sold, understand market mechanics. Understanding their structure and function is essential for making informed investment decisions.

Brokerages & Accounts:

Choosing the Right Platform to Buy, Sell, and Manage Investments

Types of Investment Accounts:

Compare taxable accounts, retirement accounts (401(k), IRA, Roth IRA), and other options to maximize tax benefits.

Choosing a Brokerage:

Learn how to select a brokerage that suits your needs, considering fees, platform usability, and investment options.

Comparing Top Brokerages:

A breakdown of leading brokerage firms to help you find the best fit for your investment goals.

Investing Strategies:

Proven Methods to Grow Wealth and Manage Risk

Top 3 Stock Investing Strategies:

Explore Value Investing, Growth Investing, and Dividend Investing to match your risk tolerance and goals.

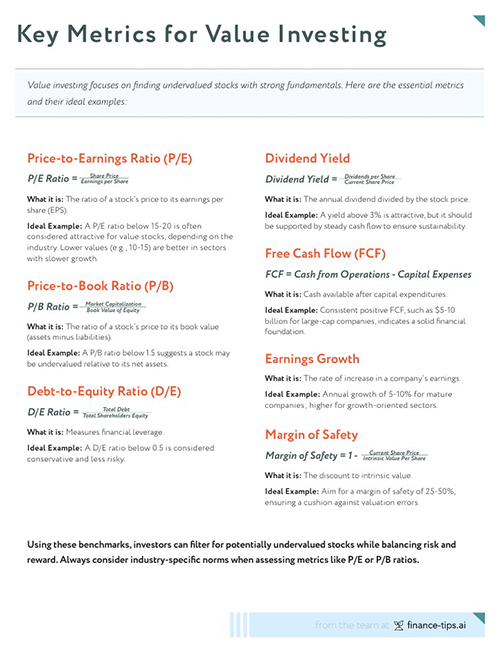

Key Metrics for Value Investing:

Learn how to analyze undervalued stocks using P/E ratios, P/B ratios, and Free Cash Flow.

Calculating Intrinsic Value:

Learn how investors determine a stock’s true worth based on fundamental analysis, including future cash flows, earnings potential, and market conditions.

Key Metrics for Growth Investing:

Identify high-growth stocks by evaluating earnings growth, market opportunities, and innovation potential.

Key Metrics for Dividend Investing:

Build a passive income portfolio with stocks that offer sustainable and growing dividends.

Stocks & Equities:

Ownership Opportunities for Long-Term Wealth Building

Common vs. Preferred Stock:

Know the differences between stock types and how they impact growth, dividends, and voting rights.

Stock Returns:

Learn about capital appreciation and dividends—two key ways to profit from stocks.

Market Capitalization:

Understand how company size affects stock performance and risk levels.

Bid & Ask Prices:

Master the mechanics of stock trading, including how stocks are bought and sold at different price points.

Order Types:

Learn about market orders, limit orders, stop orders, and how to execute trades strategically.

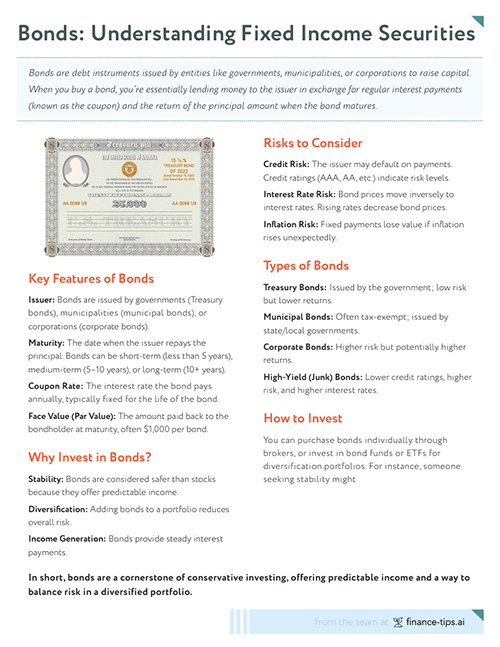

Bonds & Fixed Income:

Secure and Stable Investments for Predictable Returns

Understanding Fixed Income Securities:

Learn how bonds generate income through interest payments and provide portfolio stability.

Bond Strategies: Hold vs. Active Trading

Compare long-term investing with active bond trading strategies.

Bond Ladder:

A strategy to generate consistent returns while minimizing interest rate risks.

Bond Barbell:

Learn how to balance short- and long-term bonds for flexibility and income.

Bond Bullet:

Plan for future expenses by structuring bonds to mature at the same time.

Bond Funds & ETFs:

Understand how pooled bond investments work and their advantages.

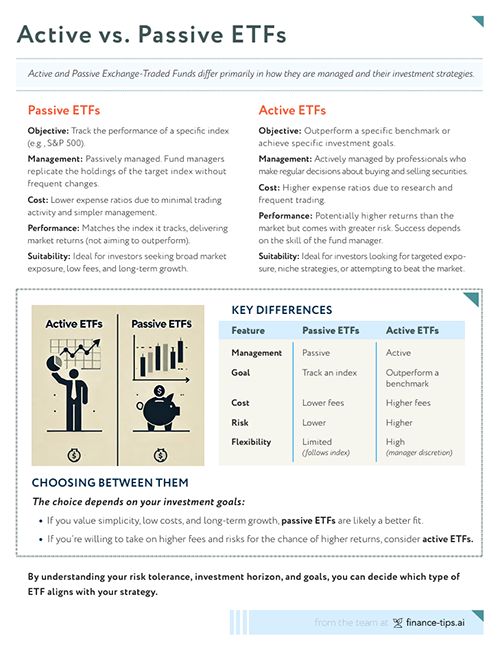

Exchange-Traded Funds:

Diversified and Low-Cost Investment Vehicles for Any Portfolio

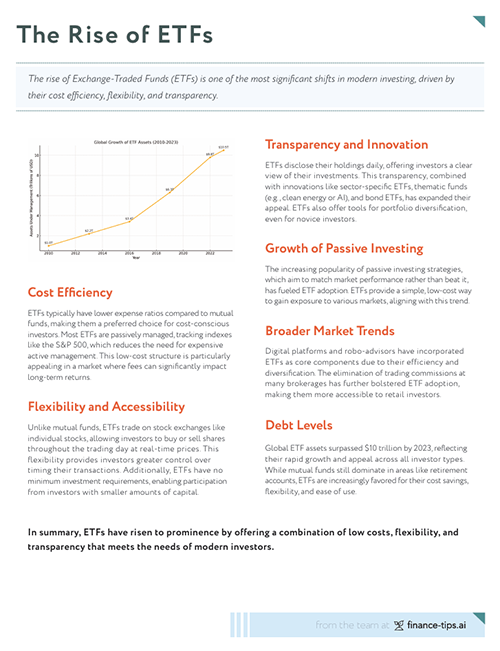

The Rise of ETFs:

Explore why ETFs have become one of the most popular investment vehicles.

Active vs. Passive ETFs:

Compare index-tracking ETFs to actively managed funds for different investment approaches.

Mutual Funds vs ETFs:

Learn the differences and when to use each investment type.

Real Estate & REITs:

Property-Based Investments for Passive Income and Growth

Real Estate Investment Trusts (REITs):

Invest in real estate without the hassle of property management—earn dividends from commercial properties.

Types of REITs:

Explore equity REITs, mortgage REITs, and hybrid REITs to find the right investment fit.

Key Metrics of REITs:

Learn how to evaluate REIT financials, income potential, and long-term growth.

Margin Trading:

Leveraging Borrowed Capital to Amplify Investment Potential

Margin Investing:

Understand how investors use borrowed funds to amplify returns, the risks involved, and why margin calls can pose significant challenges.

Margin Calls:

Learn what causes margin calls, how they impact investors, and the consequences of failing to meet one.

Options Contracts:

Advanced Trading Strategies for Hedging and Speculation

Stock Options Basics:

Explore how stock options work, including calls and puts, and how they are used to manage portfolio risk.

Common Pitfalls in Stock Options:

Learn about the risks and misconceptions surrounding options trading and why many investors approach them with caution.

The Greeks in Options Trading:

Understand key factors that affect options pricing—delta, gamma, theta, and vega—and their role in market movements.

Other Derivatives:

Exploring Futures, Swaps, and Alternative Financial Instruments

Derivatives Overview:

Gain insight into complex financial instruments like futures, options, and swaps, and why they are commonly used for risk management.

Futures Contracts:

Learn how futures contracts work, why they exist, and their role in stabilizing commodity and financial markets.

Futures Pitfalls:

Understand the risks of futures trading, including contract expirations, rollover costs, and how margin requirements can lead to forced liquidation.

Swaps Overview:

Learn about financial swaps—contracts that allow institutions to exchange cash flows, interest rates, or even currencies to manage financial risk.

Forwards Contracts:

Explore how forwards are private agreements to buy or sell assets at a future date, differing from standardized futures contracts.

Risks in Forwards & Swaps:

Understand how counterparty risk, market fluctuations, and lack of liquidity can impact these financial agreements.

30-Day Money-Back Guarantee

We’re confident that our Investing Cheat Sheets will provide you with the valuable insights and practical strategies you need to make smarter investment decisions. That’s why we offer a 30-Day Satisfaction Guarantee.

If for any reason you’re not completely satisfied with your purchase, simply reach out to our customer service team within 30 days of your purchase date. We’ll refund your money—no questions asked.

Here’s the Incredible Offer for the Launch Sale:

Investing can feel overwhelming, but having the right guidance can make a big difference. That’s why our team of analysts, developers and designers have poured countless hours into creating these Investing Cheat Sheets.

Attending investing seminars can cost hundreds or even thousands of dollars, and while those options can be valuable, they’re not always practical for everyone. The Investing Cheat Sheets were built to provide foundational investing knowledge in an accessible format, so you can learn at your own pace and refer back to them whenever you need.

For a limited time, you can get the full set of Investing Cheat Sheets for just $19 USD!

Please note: Investing always involves risk, and no single resource can guarantee returns. These cheat sheets are designed to help you build a strong investing foundation, but they are not a substitute for professional financial advice.

This special offer is only available to the first 500 customers. Don’t miss your chance to get clear, practical investing insights at a significant discount.

Discount code: LAUNCHSALE-First-500-Orders

Frequently Asked Questions

How are these cheat sheets different from a book or a course?

Unlike a traditional book or course, our cheat sheets are designed for quick reference and ease of use. They provide essential information in a simplified format, making it easy to find what you need at a glance. Plus, they’re printable, so you can have a hard copy with you whenever you need it, whether at home, at work, or on the go.

Can I print the cheat sheets?

Absolutely! The cheat sheets are designed to be printable, so you can easily print them out and keep them in a binder, on your desk, or even in your wallet for quick reference. Having a physical copy means you can access the information you need without needing to be online.

Are the cheat sheets suitable for beginners?

Yes, the Investing Cheat Sheets are perfect for beginners and those looking to refresh their investing knowledge. They break down the fundamentals of investing into an easy-to-understand format, making them ideal for anyone who wants to learn more about stocks, ETFs, bonds, diversification, and risk management. Whether you’re just getting started or looking to refine your approach, these cheat sheets provide clear, practical insights to help you navigate the world of investing with confidence.

Can I put them on my phone?

Yes, the cheat sheets come in a digital format that you can easily download and access from any device. This makes it convenient to have all the information you need at your fingertips, whether you’re at home, at work, or on the go.

Can I get a refund if I’m not satisfied?

We offer a satisfaction guarantee. If you’re not completely satisfied with your purchase, you can contact our customer service team within 30 days of your purchase for a full refund. We want you to feel confident in your investing journey, and we’re here to help.

90% Discount Ends In...

Price: $189

Today:

$19

90% off!

30 Day Money-Back Guarantee

You love the Cheat Sheets or you don’t pay for them. Simple as that.

It's decision time! You've essentially got 2 options:

Option 1: Continue on your own, piecing together bits of investing advice from all over the internet. It might take time, and there’s a chance you’ll hit some roadblocks or make costly mistakes along the way. But hey, that’s part of figuring things out!

Option 2: Fast-track your investing knowledge with our curated Investing Cheat Sheets. Designed for clarity and practicality, these guides cut through the noise, delivering expert insights, proven strategies, and actionable tips—all in one place.

You love the Investing Cheat Sheets, or you don’t pay for them. Simple as that.

© Copyright 2024 by finance-tips.ai